What Is A 403 B

403 b retirement plans for teachers non profit employees the What is a 403 b plan and how do you contribute thestreet. What is a 403 b 403 b explained castle wealth groupWhat is a 403 b youtube.

What Is A 403 B

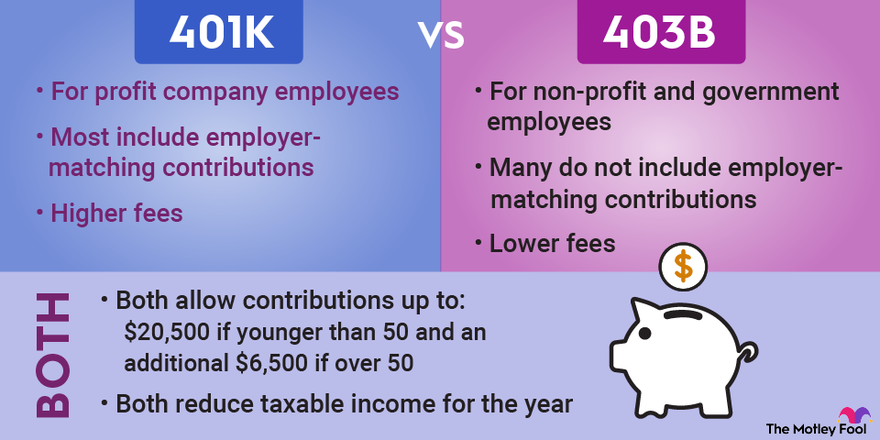

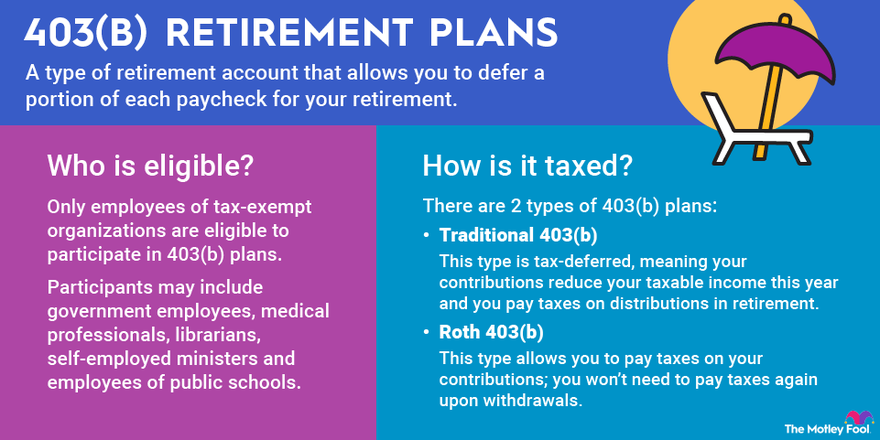

Web Jul 31 2023 nbsp 0183 32 Like a 401 k or IRA a 403 b plan is a tax advantaged savings vehicle that you can use to save for retirement However 403 b plans are typically offered only to certain employees usually those who work in a public school or at certain tax exempt organizations A 403 b plan can be a Roth or traditional account also like a 401 k What is a 403 b plan self directed retirement plans. What is a 403 b account and how to make yours better potomacThe basics of roth 403 b plans the motley fool.

403 b Retirement Plans For Teachers Non Profit Employees The

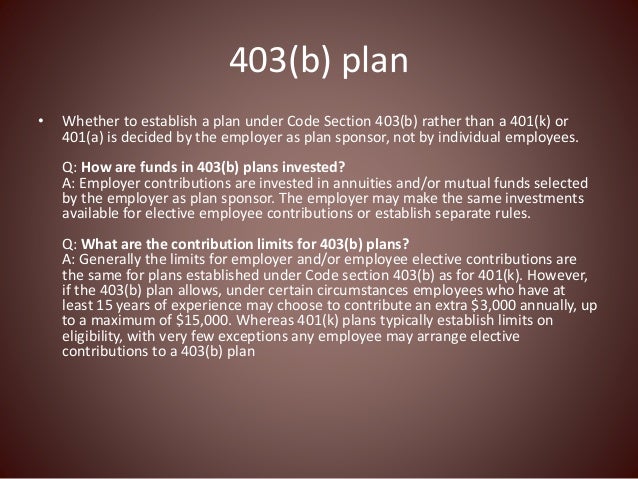

Web Mar 9 2023 nbsp 0183 32 A 403 b is a tax advantaged retirement plan designed for non profit organizations and certain government entities The 403 b works a lot like its more well known counterpart the 401 k ;Simply put, a 403 (b) is an employer-sponsored plan offered by public schools, nonprofits and other tax-exempt organizations to help employees save for retirement. Think of the 403 (b) as a big bucket you put money into for your future. Then, when you retire, you draw your income from that bucket.

Retirement Plan Basics What Is A 403 b Plan

What Is A 403 B;A 403 (b) plan is a type of retirement account available to individuals who work in public education and employees of certain 501 (c) (3) tax-exempt organizations. It’s similar to the more... Web A 403 b is a type of retirement plan available for employees in public schools charitable 501 c 3 tax exempt organizations and certain faith based organizations Employers provide access to 403 b s to attract and retain workers If you don t have access to a 403 b you can save for retirement using a different type of account